Page 1

LILAC Document Help

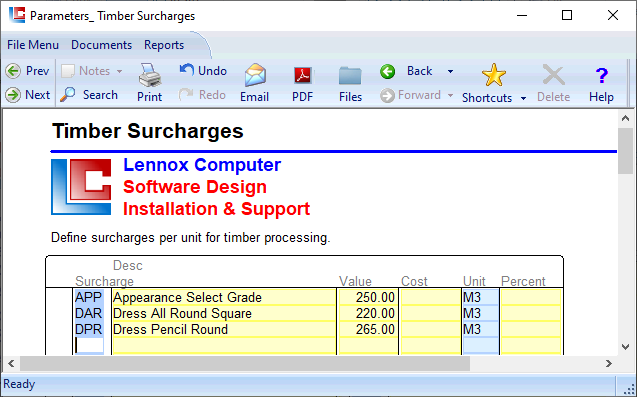

Parameters > Timber Surcharges

Surcharges are applied to a product as an additional charge.

Surcharges defined in this document will appear in the Timber Tally window.

Surcharges defined in this document will appear in the Timber Tally window.

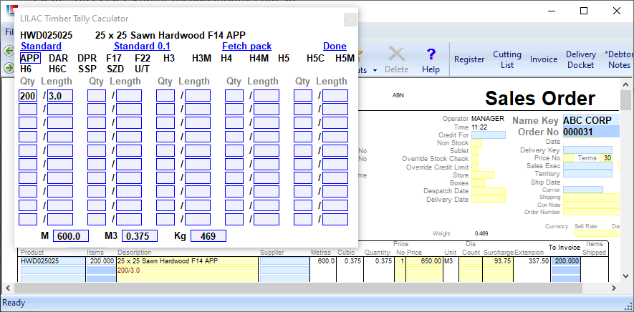

In the Surcharge field, key in an appropriate abbreviation, followed by a description, value, and unit. In the above example the value is applied per cubic metre, e.g. in the case of APP, 1 cubic metre of product sold to a customer may attract a surcharge of $250.

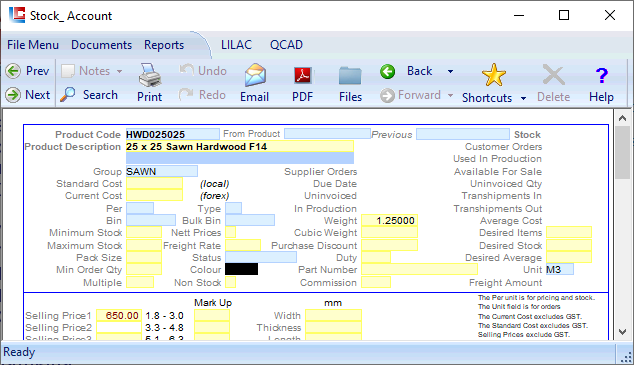

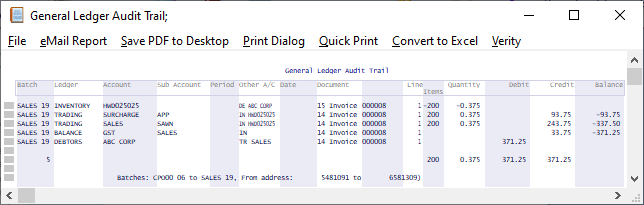

In this example, the surcharge APP is applied to 200 x 3.0m lengths of a timber product (HWD025025).

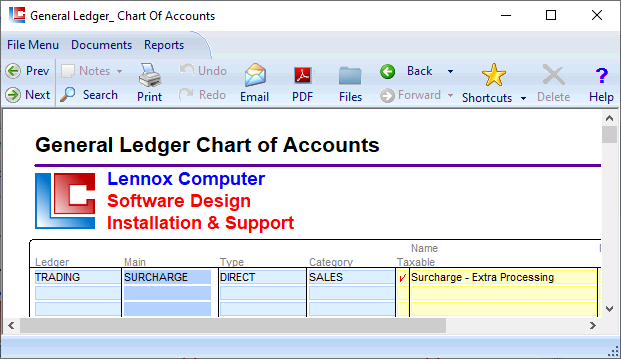

The surcharge calculation is APP $250 x 0.375 M3 = $93.75.

The timber calculation is HWD025025 $650 x 0.375 M3 = $243.75

$93.75 + $243.75 = the extension $337.50

The surcharge calculation is APP $250 x 0.375 M3 = $93.75.

The timber calculation is HWD025025 $650 x 0.375 M3 = $243.75

$93.75 + $243.75 = the extension $337.50